Swap, HODL, and Repeat: The Secret Sauce of Token Swapping Demystified!

Last Modified: Wednesday August 2nd, 2023

Table of Contents

-

Strategies for Long-Term Success in Token Swapping

- Do your research.

- Invest in projects with strong fundamentals.

- Diversify your portfolio.

- Don't be afraid to take profits.

- Be patient. HODL

- Timing Your token swaps with precision

- Continued Learning: The Currency of Knowledge

- Embracing Community: Finding Your Tribe

- Automation and Efficiency: Leveraging Tools for Success

- Learning from the Masters

Introduction:

Greetings fellow crypto aficionados! Welcome to an exciting and comprehensive journey into the captivating world of token swaps. In this guide, we will explore the intricacies of these crypto maneuvers, embracing the philosophy of achieving maximum results with minimal effort. Whether you're a seasoned trader or a curious newcomer, this guide is tailored to empower you to become a savvy token swapper.

Understanding Token Swaps

Token Swaps: The Dynamic Crypto Exchange

In this fast-paced digital era, token swaps play a vital role in the cryptocurrency world. Imagine it as the smooth exchange of one cryptocurrency for another, a powerful tool to navigate the blockchain ecosystem.

To gain a deeper understanding of token swaps, let's venture into the core of the blockchain. This ingenious technology revolutionized finance by offering transparent, decentralized transactions, eliminating the need for intermediaries.

How the Magic Unfolds

Visualize the blockchain as an intricate system of automated contracts, orchestrating the rhythm of token swapping. These smart contracts execute trades when specific conditions are met, streamlining the process of exchanging digital assets.

As we dive deeper into token swaps, we'll address potential security risks and explore strategies to mitigate them effectively. Understanding how the magic unfolds will help you make informed decisions during your crypto journey.

Understanding How Token Swaps Work in DeFi

Token swapping is the process of exchanging one cryptocurrency token for another. This can be done on a decentralized exchange (DEX), which is a platform that allows users to trade directly with each other without the need for a third party.

Token swaps work using smart contracts. Smart contracts are self-executing contracts that are stored on the blockchain. When you swap tokens, you are essentially sending a transaction to a smart contract that specifies the tokens you want to swap and the tokens you want to receive in return.

The smart contract will then execute the swap and transfer the tokens to the appropriate addresses. Token swaps are typically very fast and efficient, and they can be done with very low fees.

Token swapping is a powerful tool that can be used to diversify your cryptocurrency portfolio, take profits from your investments, and access new tokens that are not available on your local exchange.

A Basic Guide On How To Swap ERC20 Tokens:

- You choose a DEX that supports the tokens you want to swap.

- DEX Crypto Hub supports thousands of ERC20 tokens across many networks to swap to/from with a few clicks. Check us out!

- You connect your crypto wallet to the DEX.

- You specify the tokens you want to swap and the tokens you want to receive in return.

- You confirm the swap and pay the fees.

- The smart contract will execute the swap and transfer the tokens to the appropriate addresses.

- Token swaps are a great way to take control of your finances and trade directly with other users. They are also a great way to get involved in the DeFi ecosystem and access new and innovative tokens.

Imagine the DeFi ecosystem as a bustling dance floor, and smart contracts as the expert choreographers orchestrating each move of the token swap. These automated contracts execute the exchange when specific conditions are met, ensuring a smooth and secure dance between ERC20 tokens.

Step-by-Step Guide to Swapping Tokens

Let's explore the practical realm of token swapping step-by-step, in more detail, uncovering the various methods crypto enthusiasts employ to master this dynamic exchange.

-

Go to the DexCryptoHub exchange page.

-

Select the tokens you want to swap.

- In the "From" field, select the token you currently own.

- In the "To" field, select the token you want to receive in return.

-

Enter the amount of tokens you want to swap.

- In the "Amount" field, enter the amount of tokens you want to swap.

- The amount of tokens you receive in return will be calculated automatically.

-

Paste in your wallet address to receive the new tokens.

-

Review the swap details and confirm the swap.

- Review the swap details, including the amount of tokens you are swapping, the amount of tokens you will receive in return, and the fees.

-

If you are satisfied with the details, click the "Swap" button.

- You will be provided with a wallet address that can accept the currency you want to swap from. Once you send the funds to that address, the page will update on each status update as the tokens move trough the crypto world.

-

The swap will be processed and the tokens will be transferred to your wallet.

- The amount of time it takes for the swap to complete will vary depending on the network congestion, but on average it takes anywhere from 3-10 minutes.

DEXs: The Decentralized Hub

Decentralized exchanges (DEXs) serve as hubs where traders directly swap tokens without intermediaries, embracing the spirit of decentralization. Here at Dex Crypto Hub, you can do just that. You can swap your tokens from any network to any network.

Connecting your crypto wallet to a DEX platform grants you control over your trades and ensures enhanced privacy during transactions. Furthermore, on our exchange page, you don't even have to connect your wallet. You just can provide us with your wallet address and like magic, your coins are swapped. So we don't repeat ourselves too much, you can examine popular DEXs on our site and dive into their mechanics along with sharing success stories of traders who have mastered this space.

A few popular DEX's are:

-

Uniswap (UNI) is a decentralized exchange (DEX) that runs on the Ethereum blockchain. It is the most popular DEX in the world, with over $10 billion in daily trading volume. Uniswap is popular because it is easy to use, has low fees, and is permissionless, meaning that anyone can use it.

-

SushiSwap (SUSHI) is a fork of Uniswap that offers a number of improvements, including better liquidity, lower fees, and a more user-friendly interface. SushiSwap is also popular because it is backed by a large community of developers and users.

-

PancakeSwap (CAKE) is a DEX that runs on the Binance Smart Chain (BSC). It is similar to Uniswap, but it offers lower fees and faster transactions. PancakeSwap is popular because it is easy to use and has a large community of users.

-

Pulsechain is a fork of the Ethereum blockchain that is designed to offer faster transactions, lower fees, and greater scalability. It is still under development, but it has the potential to become a popular DEX. Pulsechain is popular because it offers a number of advantages over Ethereum, including:

-

Faster transactions: Pulsechain transactions are expected to be much faster than Ethereum transactions. This is because Pulsechain uses a different consensus mechanism than Ethereum, which is more efficient.

-

Lower fees: Pulsechain fees are expected to be much lower than Ethereum fees. This is because Pulsechain does not have the same level of congestion as Ethereum.

-

Greater scalability: Pulsechain is designed to be more scalable than Ethereum. This means that it can handle more transactions per second, which will make it more suitable for DeFi applications.

-

Disclaimer: Pulsechain is still under development, but it has the potential to become a popular DEX. It is worth keeping an eye on Pulsechain as it develops.

-

-

Avalanche is a layer-1 blockchain that is designed to be scalable, secure, and easy to use. It is a popular choice for DeFi applications and has a number of DEXes running on its network, including Pangolin, Trader Joe, and SushiSwap.

-

Avalanche is popular because it offers a number of advantages over other blockchains, including:

-

Scalability: Avalanche is designed to be highly scalable. It can handle up to 4,500 transactions per second, which is much more than Ethereum.

-

Security: Avalanche is a secure blockchain. It uses a proof-of-stake consensus mechanism that is more secure than proof-of-work.

-

Ease of use: Avalanche is easy to use. It has a simple user interface and is easy to set up.

-

-

QuickSwap (QUICK) is a DEX that runs on the Polygon network. It offers low fees and fast transactions, making it a popular choice for traders who want to avoid the high fees of Ethereum.

-

Dodo (DODO) is a DEX that uses an innovative order book system to match buyers and sellers. This makes Dodo more efficient than other DEXes and allows it to offer lower fees.

-

Zapper (ZAP) is a DEX aggregator that allows users to compare prices across multiple DEXes. This makes it easy for users to find the best price for their trades.

-

Honeyswap (HONEY) is a DEX that runs on the Harmony blockchain. It offers low fees and fast transactions, making it a popular choice for traders who want to avoid the high fees of Ethereum.

-

Trader Joe is a decentralized exchange (DEX) that runs on the Avalanche network. It is a popular choice for traders who want to trade Avalanche-based tokens. Trader Joe offers a number of features that make it a popular choice, including:

-

Liquidity: Trader Joe has a large pool of liquidity, which makes it easy to find buyers and sellers for your tokens.

-

Low fees: Trader Joe fees are very low, which makes it a cost-effective way to trade tokens.

-

Simplicity: Trader Joe is easy to use, even for beginners.

-

Security: Trader Joe is a secure platform that uses a number of security measures to protect your funds.

-

Trader Joe is a popular choice for traders who want to trade Avalanche-based tokens. It offers a number of features that make it a popular choice, including liquidity, low fees, simplicity, and security.

-

I have personally used TraderJoe on multiple occasions.

-

AMMs: Automated Market Makers at Play

Automated market makers (AMMs) are algorithm-driven platforms that facilitate seamless swaps without the need for a direct trading partner.

The secret to their success lies in liquidity pools, where participants contribute tokens to ensure ample liquidity for smooth trading. While impermanent loss poses a risk, we'll delve into risk management strategies to minimize its impact.

💡 My favorite network that offer these types with high yields and low fees is Pulsechain. We have an entire post dedicated to networks and the likes that you can find on our site.

Diversify your portfolio.

By diversifying your portfolio, you can reduce your exposure to impermanent loss. This is because if the price of one token in your pool falls, the price of another token in your pool may rise, offsetting some of your losses. For example, if you have a pool of ETH and BTC, and the price of ETH falls, the price of BTC may rise, and you may not experience any impermanent loss.

Use stablecoins.

Stablecoins are less volatile than other cryptocurrencies, so they are less likely to experience impermanent loss. If you are concerned about impermanent loss, you may want to consider using stablecoins in your liquidity pools. For example, you could create a pool of USDT and DAI, which are both stablecoins.

Use a stop-loss order.

A stop-loss order is an order that automatically sells your tokens if the price falls below a certain level. This can help you to limit your losses if the price of a token in your pool falls sharply. For example, you could set a stop-loss order for your ETH/BTC pool at 0.08 BTC. This means that if the price of ETH falls to 0.08 BTC, your tokens will be automatically sold.

Learn from the mistakes of others.

There are a number of stories of people who have lost money due to impermanent loss. For example, one person lost $10,000 when they provided liquidity to a pool of ETH and BTC. The price of ETH fell, and the person lost money even though the overall value of the pool did not change. In this case, it all came back! HODL!

By learning from the mistakes of others, you can avoid making the same mistakes yourself. If you are considering providing liquidity to a liquidity pool, be sure to understand the risks involved and take steps to minimize your losses.

Learn from others

I've been involved in the crypto space for a number of years now, and I've seen a lot of people lose money due to impermanent loss. That's why I'm always preaching the importance of risk management.

If you're going to provide liquidity to a liquidity pool, be sure to diversify your portfolio, use stablecoins, and use a stop-loss order. These are just a few simple steps that can help you minimize your losses.

💡Of course, no risk management strategy is perfect. There will always be a chance that you could lose money. To recap, following these tips can reduce your risk and increase your chances of success.

-

Risk Management

-

Impermanent loss

-

Diversification

Navigating the Crypto Landscape

Token swaps, like you can do on our exchange page, allow you to diversify your portfolio, expanding beyond popular cryptocurrencies like Bitcoin and Ethereum.

We'll explore the wonders of DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and the latest altcoins, empowering you to make strategic moves and navigate the ever-changing crypto landscape.

Defi Is The Way

Defi is is a hot topic in the crypto space right now. It's a way to access financial services without using a traditional bank or financial institution. DeFi applications are built on top of blockchains, and they allow users to lend, borrow, trade, and invest their money without having to trust a third party.

NFT's

NFT's are another exciting development in the crypto space. They're digital tokens that represent ownership of something unique. NFTs can be used to represent ownership of art, music, collectibles, and even real estate.

What are Alt coins

Alt Coins are any cryptocurrency that is not Bitcoin or Ethereum. There are thousands of altcoins out there, and they offer a wide variety of features and benefits. Some altcoins are designed to be more secure than Bitcoin, while others offer faster transaction speeds.

So, how do you know which coins are legit and which ones are scams?

💡 Here are a few tips:

-

Do your research. Before you invest in any coin, be sure to do your research. Read the whitepaper, look at the team, and check out the community.

-

Be wary of promises of high returns. If someone is promising you high returns with little risk, it's probably a scam.

-

Don't invest more than you can afford to lose. Crypto is a volatile market, and there's always the risk of losing money.

If you're looking for a safe and secure place to trade tokens, check out our exchange page. We offer a wide variety of coins to choose from across a multitude of networks, and we have a team of experts who can help you get started.

We also have a blog where you can learn more about DeFi, NFTs, altcoins, and other need-to-know information to make you as successful as possible.

The crypto space is constantly evolving, so it's important to stay informed. By following these 💡 tips, you can help protect yourself from scams and make informed investment decisions.

Unfortunately, even the best of us have been scammed at one time or another. My story begins with being new to the crypto space. I was looking for a way to make some quick money. I came across a website that promised high returns on investments in a new altcoin. I invested a small amount of money, but the coin quickly crashed and I lost everything.

This experience taught me a valuable lesson about the importance of doing your research before investing in any coin. I also learned that there are a lot of scammers out there who are looking to take advantage of people who are new to the crypto space.

I hope this section has helped you learn more about DeFi, NFTs, and altcoins. By following the tips I've provided, you can help protect yourself from scams and make informed investment decisions.

Liquidity Provision: Contributing to Market Health

Token swapping plays a vital role in providing liquidity to the crypto market. Providing liquidity can be very lucrative. By becoming a liquidity provider, you contribute to a vibrant market and earn rewards in return.

As a liquidity provider, you deposit tokens into an AMM's liquidity pool, ensuring smooth trading for the community.

Risks and Considerations of Token Swapping

Navigating the Crypto Space with Confidence

While token swaps offer opportunities, it's crucial to master risk management and make informed decisions just as you would in the stock market.

We'll address impermanent loss and explore techniques to minimize its impact. Additionally, we'll emphasize the importance of staying informed about security practices to safeguard your investments.

What is Impermanent Loss

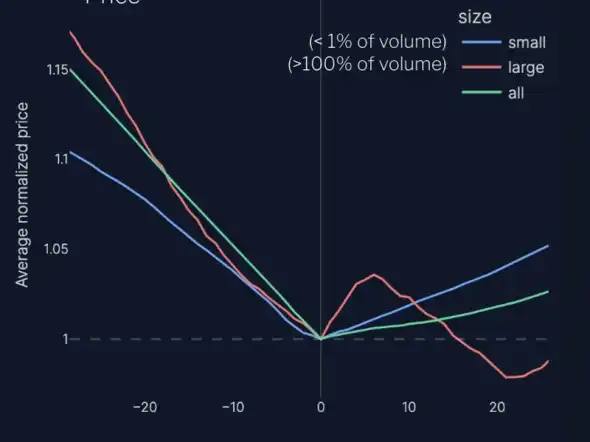

Impermanent loss is the loss of value that can occur when you provide liquidity to a liquidity pool. This loss occurs because the price of the tokens in your pool can change relative to the price of the tokens when you deposited them.

If you remember, I had an example above about losing $10,000 in a BTC ETH liquidity pool. Using that example, let's say you provide liquidity to a pool of ETH and BTC. The price of ETH then falls, and the price of BTC rises. Your pool will still have the same overall value, but the value of your ETH will have decreased. This is because you have less ETH than you would have if you had simply held onto your ETH.

The amount of impermanent loss that you experience will depend on the volatility of the tokens in your pool and the amount of time that you leave your tokens in the pool. The more volatile the tokens and the longer you leave your tokens in the pool, the more impermanent loss you are likely to experience.

There are a few things you can do to minimize the impact of impermanent loss:

-

Diversify your portfolio. By diversifying your portfolio, you can reduce your exposure to impermanent loss. This is because if the price of one token in your pool falls, the price of another token in your pool may rise, offsetting some of your losses.

-

Use stablecoins. Stablecoins are less volatile than other cryptocurrencies, so they are less likely to experience impermanent loss. If you are concerned about impermanent loss, you may want to consider using stablecoins in your liquidity pools.

-

Use a stop-loss order. A stop-loss order is an order that automatically sells your tokens if the price falls below a certain level. This can help you to limit your losses if the price of a token in your pool falls sharply.

While not trying to sound like a broken record (as I briefly touched on these topics above), it is so important for me to make sure I drive my point home!

The crypto space is constantly evolving, so it's important to stay informed. By following these tips, you can help protect yourself from impermanent loss and make informed investment decisions.

Strategies for Long-Term Success in Token Swapping

Do your research.

Before you invest in any altcoin, be sure to do your research. This includes reading the whitepaper, looking at the team, and checking out the community.

Invest in projects with strong fundamentals.

When you're investing and swapping tokens in altcoins, it's important to invest in projects with strong fundamentals. This means projects that have a good team, a solid roadmap, and a working product.

Diversify your portfolio.

Don't put all your eggs in one basket. When you're investing in altcoins, it's important to diversify your portfolio. This means investing in a variety of different altcoins, not just one or two. Swap tokens if you feel your too weighted in one coin or another.

Don't be afraid to take profits.

When you're trading altcoins, it's important to take profits when you can. This means selling your altcoins when they've reached a certain price target.

Be patient. HODL

The crypto market is volatile, so it's important to be patient and HODL when you're trading altcoins. Don't expect to get rich quick.

Timing Your token swaps with precision

As with any endeavor, timing is essential in token swapping.

Continued Learning: The Currency of Knowledge

In the ever-evolving crypto space, knowledge is your most valuable asset. Dive into reliable resources like Dex Crypto Hub for expanding your knowledge, staying updated with industry trends, and making informed decisions.

Embracing Community: Finding Your Tribe

No trader is an island. Building a network of like-minded individuals who share insights and collaborate is instrumental in your crypto journey. Get good at connecting with the crypto community and tap into its collective wisdom.

Automation and Efficiency: Leveraging Tools for Success

In the spirit of making money and what fees are associated, explore automation tools that streamline your token swaps, like our exchange page. Optimize efficiency too maximize your results. From trading bots to portfolio trackers, equip yourself with the tools to become a more efficient crypto trader.

Learning from the Masters

Be careful who you watch on YouTube, read on Reddit, and get pitched crystal-ball type information on Facebook.

Pitfalls to Avoid in Token Swapping

A major pitfall is using a centralized exchange, where if it's not your wallet, it's not your money. Centralized exchanges are more vulnerable to hacks and other security risks. If you use a centralized exchange to swap tokens, you run the risk of losing your funds.

The best way to avoid these pitfalls is to use a decentralized exchange like Dex Crypto Hub. Dex Crypto Hub is a secure and reliable exchange that allows you to swap tokens without the risk of impermanent loss or security breaches.

In addition to being secure, we also provide a very user-friendly experience as well as assistance should you have any questions. You can swap tokens with just a few clicks, and you'll have access to a wide variety of tokens, including stablecoins and altcoins.

So if you're looking to swap tokens, don't make the mistake of using a centralized exchange. Use our exchange page and avoid the pitfalls of token swapping.

Embrace the Crypto Dance

Congratulations, you've mastered the art of token swaps! By following the our philosophy, you can achieve maximum results with minimal effort in the world of crypto exchanges.

Embrace the vibrant world of token swaps, seize opportunities, and navigate the crypto landscape with confidence. With continuous learning, strategic moves, and a strong community, your crypto portfolio will soar to new heights. Until we meet again, happy trading, and may your crypto journey be filled with success!

Disclaimer: The information in this article is for educational purposes only and should not be construed as financial advice. The author is not a financial advisor and does not provide financial advice. The author is not responsible for any losses or damages that may occur as a result of using the information in this article.

Related Posts

Oauth using facebook with flask,mysql,vuejs and tailwind css

Learn how to authenticate users to your application using facebook.

Authenticating users with email verification in Django apps

Learn how to authenticate users to your web application by sending secure links to their email box.

Creating user registration and authentication system in flask

Learn how to authenticate users to your application using flask and mysql db.